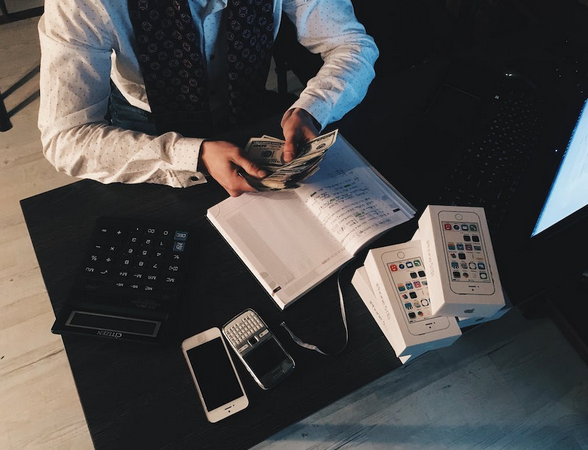

Tips To Hiring An Accounting Firm

One might be able to do their bookkeeping or file their taxes. However, there are instances where a person will benefit from hiring a certified accounting firm or accountant. Such professionals stay up to date with new laws and will be able to offer financial advice and assist their clients with various financial needs. When planning to hire an accountant, it is important to have a few considerations.

Hiring An Accounting Firm

Recommendations

A place to begin in getting an accounting firm is by getting referrals. Inquire from individuals and businesses in the same field who have received the services of an accounting firm. Find out whether they were satisfied with the work. Another way of finding an accounting firm is from directories and online searches. Look at client testimonials and feedback regarding the work that has been done to get more information about the company.

Business Needs

Determine your business needs. What would you want the accounting firm to handle? Do you want the books to be handled, taxation or advice and goals and strategies to grow your business? Knowing your needs will help you communicate what your expectations are to the accounting firm.

Qualification

Look for accountants who have been certified. There are different levels of accountants all with varying degrees of education. There are those with a globally recognized certification and licensing. Others with advanced managerial skills, while others with general certification for providing financial statements and reports. For some of this levels, one needs to have a certain amount of experience and level of education.

Experience

Another factor to look at is the experience of the firm. What business portfolio do they have? Who are their clients, have they handled clients who are in a similar field as you. One can interview the clients and find out how the services have been. Are they available and have they delivered on the required expectations. A certain level of expertise is required to handle certain issues. according to Wynkoop & Associates, CPA big firms will have a range of accountants to manage clients accounts who have specialized in different aspects of accounting. However, for a smaller firm, it is important to find out whether they will be able to handle and resolve issues that may arise.

Fee

Cost and rates is a critical element as one looks to hiring an accounting firm. Fees vary from one company to another. Some charge as per the task being performed other by the minute. It is good to clarify the terms before engaging and hiring an accounting firm.

Cost and rates is a critical element as one looks to hiring an accounting firm. Fees vary from one company to another. Some charge as per the task being performed other by the minute. It is good to clarify the terms before engaging and hiring an accounting firm.

Finally, find out about the availability of the accounting firm. Some clients prefer regular meetings and communication. While other customers are content with meeting their accountants during critical financial times and seasons like the tax – filing season or when making yearly budgets and annual reports.…

Read More

Understanding The Role Played By Chartered Accountants in Brighton & Hove

When setting up a business, most entrepreneurs are the inspired by the desire to do what they can do best. As such, their objective is usually to get the best from their efforts. In this regard, most of them are forced to take the responsibility of overseeing or managing their business accounts to achieve their entrepreneurial goals. However, it gets to a point when juggling between routine operations and finances becomes overwhelming. At such a point, the need to delegate some function like accountancy should not be overlooked.

In recent years, the accountancy profession has witnessed significant changes. The complexity of business operations and legal requirements in cities like Brighton & Hove have placed enormous responsibilities on chartered accountants. As such, small and companies operating in East Sussex should delegate their accounting functions to chartered accountants operating in brighton & hove. Notably, the role played by accountants varies depending on their areas of specialization. However, some of the most important ones are listed below.

Services offered by chartered accountants

Accountancy

In simple terms, accountancy describes keeping financial records and doing business taxes. Ideally, this is usually a wide area that ranges from simple bookkeeping operations to conducting complex fiscal analyses. Preparing and filing tax returns is another function that is of utmost importance to any business. A chartered accountants comes with the experience and expertise needed to ensure your finance department is in order.

Cost Accounting

Cost accountancy is an invaluable service for businesses that deal with production of goods and services. For instance, chartered accountants might be of great help to oak framers in Brighton & Hove troubled by controlling or managing their costs. As such, small and medium enterprises will benefit from introduction of cost control methods, managing finances along with any financial issue in the production department.

Auditing

Auditing is possibly one of the most important roles of a chartered accountant. From their expertise and training, chartered accountants play critical role in ensuring that the financial records of a business are drawn in accordance to accounting principles. The main objective of auditing is to ensure that your financial statements represent a fair and true view of the operations of the business.

Auditing is possibly one of the most important roles of a chartered accountant. From their expertise and training, chartered accountants play critical role in ensuring that the financial records of a business are drawn in accordance to accounting principles. The main objective of auditing is to ensure that your financial statements represent a fair and true view of the operations of the business.

Management Accounting

Chartered accountants can be of great help in this area. Ideally, an accountant should assist you in streamlining the operations of a business. They can achieve this by using their expertise for better policy formulation, operational control and performance evaluation among others.…

Read More